Many times home ownership is a matter of working years to qualify for a home loan (clean up credit, pay down bills) only to have some disaster eat up your down payment. We might just be able to help! Did you know that we have access to Federal grant money through an approved Lender?

All programs have income restrictions (ask for Grant income Key by County and State) and are incrementally forgiven over a 5yr period. Let me know which plan you think you qualify for and I'll send you a more information specific to that program! GRANT PROGRAM First Time Homebuyer - Maximum Grant $5000 Eligible Use of Funds: Down-Payment, Closing Cost, and principle Re- duction assistance for the purchase of an ex- isting unit. Combine with FHA, USDA, or Homeready Loans. Eligible Properties: Owner Occupied 1-4 Family, Town Houses and Con-dos, Foreclosed Properties, New Construction (w/in 45day). Eligible Borrowers: Funds may only be avail-able to a “first time homebuyer” as such term is defined by HUD HOC reference guide Chapter 3, expanded to include recovering victims of catastrophic loss or natural disaster. Other Eligibility Requirements: Retention Period is 5 yrs. Income eligibility is <80% of County Area median income. Community Partners - Maximum Grant $7500 Eligible Use of Funds: Down-Payment, Closing Cost, and principle Reduction assistance for the purchase of an existing unit. Combine with FHA, USDA, or Homeready Loans. Eligible Properties: Owner Occupied 1-4 Family, Town Houses and Con-dos, Foreclosed Properties, New Construction (w/in 45day). Eligible Borrowers: Current or retired law enforcement officers, educators, firefighters, health care workers, and other first responders who are “first time homebuyers” or Non- first time homebuyers. Other Eligibility Requirements: Retention Period is 5 yrs. Income eligibility is <80% of County Area median income. Veterans Purchase Product - Maximum Grant $7500 Eligible Use of Funds: Down-Payment, Closing Cost, and principle Reduction assistance for the purchase of an existing unit Combine with VA Loans Eligible Properties: Owner Occupied 1-4 Family, Town Houses and Con-dos, Foreclosed Properties, New Construction (w/in 45day). Eligible Borrowers: First time or non-first time veteran homebuyers that are currently serving or have served in any branch of the US military, their spouses, or their surviving spouses. Other Eligibility Requirements: Retention Period is 5 yrs. Income eligibility is <80% of County Area median income. Returning Veterans Purchase Product - Maximum Grant $10000 Eligible Use of Funds: Down-Payment, Closing Cost, and principle Reduction assistance for the purchase of an existing unit. Combine with VA Loans Eligible Properties: Owner Occupied 1-4 Family, Town Houses and Con-dos, Foreclosed Properties, New Construction (w/in 45day). Eligible Borrowers: First time or non-first time homebuyers that are currently serving or have served in an over-seas military intervention for any branch of the US military, their spouses, or their surviving spouses. Other Eligibility Requirements: Retention Period is 5 yrs. Income eligibility is <80% of County Area median income. An example for Virginia of County Area Median Income (AMI) Counties: Clarke, Fairfax, Loudoun, Prince William Household size - 80% AMI: 1 person - $60,800; 2 person - $69,520; 3 person - $78,240; 4 person - $86,880 This document is not a complete description of these programs. For further information please contact Dennis Bell, Samson Properties at 703.928.4428 or Rob Suling, Pesidential Bank NMLS#790493, 703-966-9960

1 Comment

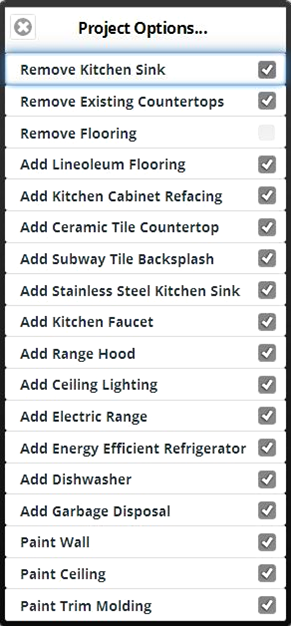

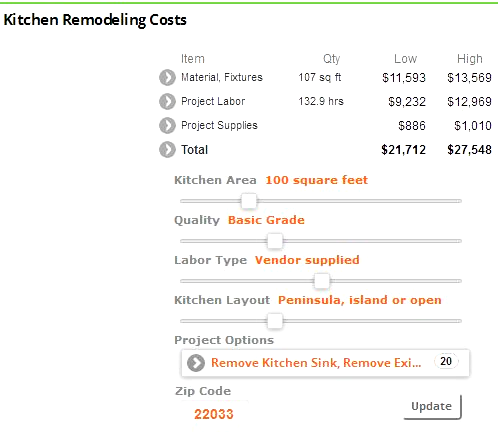

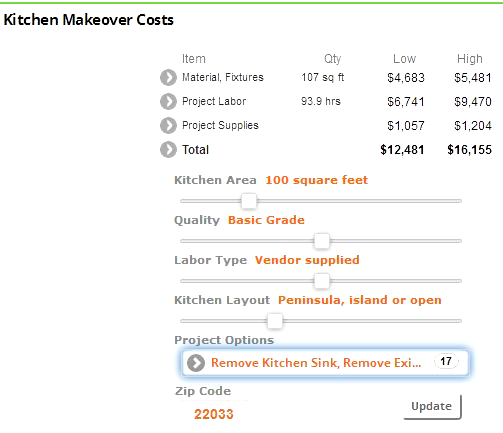

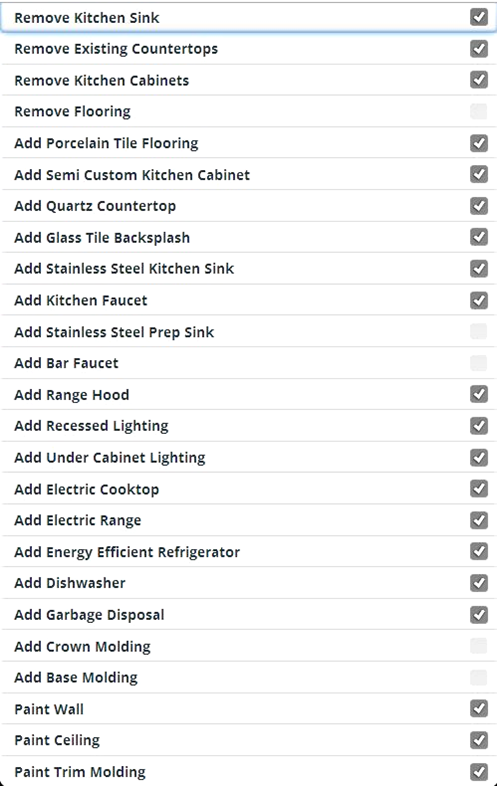

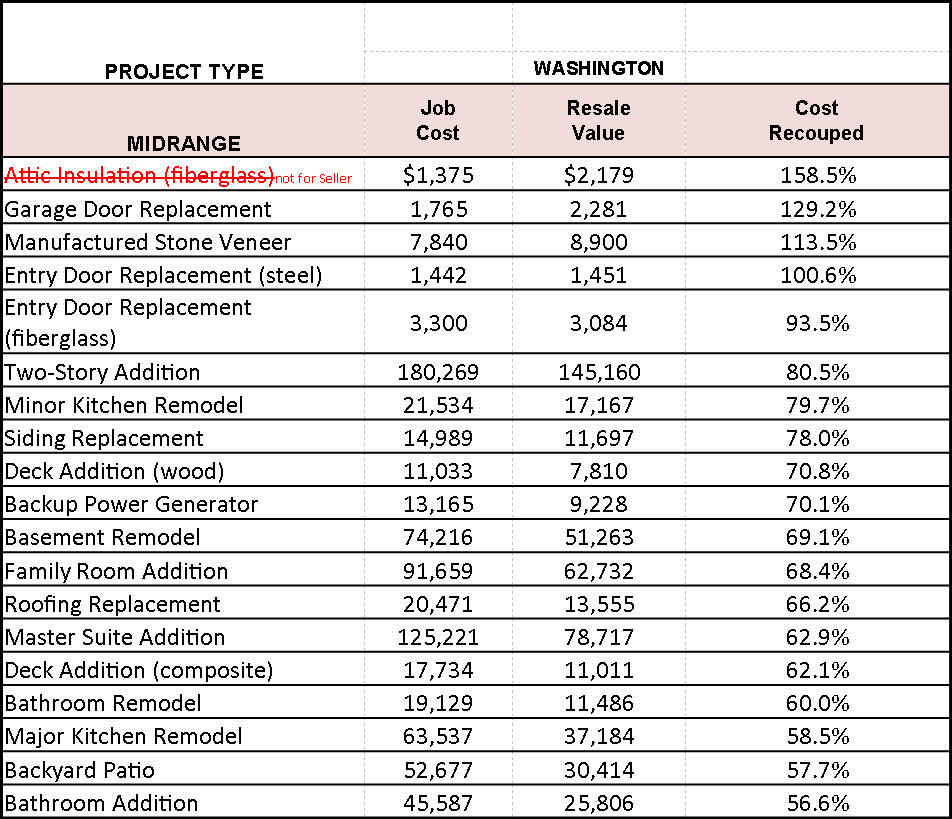

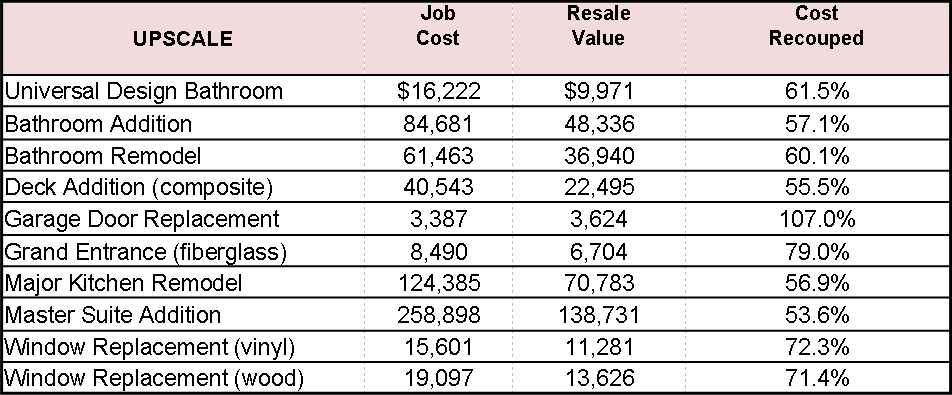

Take inventory of the big things first like outside “front” appearance, siding and shutters, windows, HVAC, Roof and Water systems. Your repairs here will cost you less now than “post” home inspection. Home repairs are one thing and upgrades and additions are another. Now, if you need to renovate or makeover, the following will show where you get the biggest bang for your buck.

The following is a comprehensive list of projects and their associated cost vs. value according to the Remodeling 2017 Cost vs. Value Report (www.costvsvalue.com). Remember that every home, neighborhood, and need is different so VIEW your home as a BUYER. Also call me to show you the competition when you have the time to view. As you begin to get things ready for sale you may not have the time to look. according to the Remodeling 2017 Cost vs. Value Report (www.costvsvalue.com) If your renovating a well lived in home and then selling, the returns are not so great. Some agents will “pitch the Renovate to get highest dollar” and pay the contractors out of the proceeds of your sale at closing. That is, the contractor puts a lien on your home in order to be paid for your renovations (before you get the net proceeds) at closing. To me, if your not getting all of your money back there is little benefit in not paying for the work while it's being done. There’s no right or wrong, just the best outcome for the least money.

Credit The following are Credit tips that I share with clients to help improve their personal credit scores. Knowing where you stand with your credit months to years before your home search will save you weeks to months during your home search. Raising your credit score will help you get approved for a mortgage loan and could save you thousands of dollars with a lower interest rate. Some of the credit tips I suggest are: 1. Check your credit report- Credit Karma is free and the worst thing is not knowing what your credit score is and what outstanding items appear on your credit report. But keep the credit inquiries to a minimum. Each pull by you or a Creditor does impact the score. 2. Setup payment reminders- Every account has “account alerts” so you will never forget that odd payment due date in the middle of the month. 3. Reduce the amount of debt you owe- One of the key elements that credit scoring models use is usage percentage. You should never owe more than 30% of your credit limit at any time. If you owe $8000 on a $10000 debt limit you have reached an 80% usage percentage and your score will suffer even if you pay on time. 4. Pay your bills on time- delinquent payments if only a few days late and collections can have a major impact. 5. If you have missed payments- get current and stay current- If you miss a January payment and make it in February than that payment was for January. Then the next payment in March was really for February. They will report you 30 days late every month. I have seen reports that show 10 months of 30 day lates. If you look at the report it was late once, and the borrower made payments but never caught up. This is called a rolling 30 day late. Call the creditor and get caught up. 6. Call the creditor- If you are having trouble making timely payments CALL the creditor and let them know the situation. Many times the creditor will work with you regarding the scenario and may never report you late or perhaps take a lesser payment. 7. Pay off Rather than moving it around- The most effective way to improve your credit score Credit Score When a Client needed to pre-qualify for their loan they completed the online application at www.robsuling.com and Rob pulled credit and there was a block on their Transunion report and he was only able to access Equifax and Experian. This is not uncommon…so he called to say, I only got two scores….right now I have to use the lower of the two I pulled which is a 702. If I can pull the third score and it is higher, it might save you some money. So the Client decided to have the block removed and try for the higher score. EXAMPLE Credit score of 780 on a $300k loan with 20% down is 4.125% with no points Credit score of 700 on a $300k loan with 20% down is 4.375% with no points So…a $44/mo difference or $16,148 over the course of 30 yrs. The borrower said, “that’s good…because I pulled 775 on Transunion from Credit Karma, I removed the block…go ahead.” So Rob re-pulled credit…… and pulled a 707 with Transunion So Rob called the borrower back and said, I just re-pulled credit and got a 707… So the borrower went back and after spending hours on the phone with Transunion, discovered that an old creditor had miss-reported a transaction and showed it as delinquent. So he said he would dispute the issue…. -----STOP----- Now that causes a problem for the mortgage. Mortgage companies use the application they take plus the credit report pulled and we input that into either Freddie Mac or Fannie Mae’s Automated underwriting engine. If the system reads the “dispute” language from the credit report, it thinks the info is inaccurate and shoots out an “error msg”. Most banks need an approval from the credit engine to approve the loan. The bottom line was that he was being quoted a score from Credit Karma that was inaccurate. So the moral of the story is if you have a client that wants to get pre-qualified, starting things early is always the best idea. In this case, the borrower was able to go back and remedy the credit error, get documentation, and TWO of the three scores that were reflecting the error shot up 80 points. $16k back in his pocket with a little up front homework! Questions about your situation? Feel free to contact Dennis Bell, Realtor – Relocation Consultant, Samson Properties, 14526 Lee Road, Suite 100, Chantilly, VA 20151, 703.928.4428, [email protected] and Rob Suling, VP Presidential Bank Mortgage, a Division of Presidential Bank, FSB, Cell: 703.966.9960. |

Moving to Northern Virginia

Dennis Bell and a lot of folks who have helped thousands to relocate. Archives

October 2018

Categories |

RSS Feed

RSS Feed