|

Buying a home is a complex process with many factors to consider. Following these 10 steps will prepare you for the decisions you'll need to make along the way. STEP 1—DEFINE YOUR GOALS Buying a home may seem like a goal in itself, but it's also the means to achieve other goals. Knowing why you're buying will help you define your criteria and make your search quicker and easier. Is this your first home purchase? If so, why do you want to own rather than rent? Is it for the future return on your investment? For the freedom to improve your home according to your own tastes and needs? Because you've decided it makes more sense to pay your own mortgage instead of someone else's? Are you changing locations to be closer to work, schools, family or recreation? Are you seeking more peaceful surroundings away from crowds and traffic? Or do you want to be where the action is? Are you moving to meet the needs of a growing or shrinking family? Are you seeking a different lifestyle? Just as the foundation provides support for a home, answering these types of questions will lay the groundwork for a smooth home purchase. STEP 2—ANALYZE YOUR WANTS AND NEEDS Once you know why you're moving, consider the qualities in your new home that will achieve your goals. What size lot will you want? How many bedrooms and bathrooms? Do you have a style or layout preference? Would a low-maintenance home, such as a condo or townhome, best suit your needs? Are amenities—such as a pool, fitness center, tennis courts, walking trails or golf courses—important to you? What about location? Once you have a list of the things you're looking for in a home, group them into categories. Make lists of the things your home must have, the things you'd like it to have, and the things it can't have. Because it's extremely rare to find the "100% home," this list will help you make decisions as you evaluate your options. STEP 3—EXPLORE FINANCING OPTIONS AND DETERMINE YOUR PRICE RANGE The thought of taking on a mortgage—whether it's your first one or a bigger one is perhaps the scariest part of a home search for many buyers. But you have nothing to fear from meeting with a lender, even if you have concerns about your credit. Helping people find their way to home ownership is what they do every day. Ask your real estate agent to recommend a reputable lender, so you'll know you're in good hands. Your lender will determine the best financing program for you and help you focus your search on the wisest price range. Knowing what you can afford before you start looking at homes can help you avoid big disappointments down the road. STEP 4—SELECT AND VIEW HOMES THAT MEET YOUR CRITERIA Thanks to the Internet, searching for homes is much easier today than in years past. With the click of your mouse, you can browse the multitude of homes on the market, view photos and read detailed descriptions to quickly narrow your focus to the homes that will best suit your wants and needs. You'll want to view enough properties to get an idea of what the market has to offer. But touring too many homes can create "home shopping fatigue" and make decisions more difficult. There is more to finding the right home than you can learn from virtual tours and floor plans. A licensed real estate agent can help you identify those that are most likely to be "winners." STEP 5—MAKE AN OFFER You've found the perfect home! It's time to make an offer. Oral agreements are not legally enforceable, so any offer to purchase real estate should be in writing. All terms and conditions of the sale must be addressed in the offer. If you are working with a real estate agent, he or she will ensure that all of the bases are covered. Your agent will also help you to negotiate the best price and terms and protect your interests throughout the negotiations. STEP 6—INSPECT THE PROPERTY

Once you and the seller have agreed on price and terms and you have a signed contract, you'll want to perform a thorough inspection of the home to ensure it is in good condition. A licensed home inspector will assess the condition of the property, note any repairs that are needed, and verify that all major systems are functioning properly. In addition to a general home inspection, you should have a survey conducted to determine the legal boundaries of the property; and a termite inspection, which may be required by your lender. When you have the results of your inspections, you may wish to negotiate with the seller to complete any needed repairs before closing. STEP 7—COMPLETE THE MORTGAGE PROCESS As soon as the contract is signed, you'll need to complete your application for a mortgage if you haven't already done so. Your lender will oversee the process and may request additional documentation related to your finances. STEP 8—CHOOSE AN ATTORNEY TO HANDLE CLOSING Real estate closings are typically handled by attorneys who specialize in real estate, but in some states may be handled by title or escrow companies. The attorney you select will research the title on the property, check for liens or past due taxes, prepare all necessary documents, and conduct the actual closing. If you do not already know a real estate attorney, ask your real estate agent for recommendations. STEP 9—CLOSE ON THE PROPERTY At closing, the seller and buyer sign all papers related to the sale of the property, and the deed is transferred from seller to buyer. While you can expect to sign your name on a multitude of documents, don't be intimidated. Your attorney and real estate agent will explain everything so you'll understand and feel comfortable with the process. STEP 10—MOVE IN! Once the deed has been recorded at the courthouse, you've officially bought a home! When you've received the keys to your new home, all that's left is moving in. Whether you elect to move yourself or use a moving company (your agent can recommend reputable companies), there will be many details to attend to. Many real estate agents offer moving checklists and resources to guide you through the transition and make your move as smooth as possible. THE NUMBER ONE TIP FOR AN EASY HOME PURCHASE To make your home purchase go as smoothly as possible, there is no substitute for working with an experienced, licensed real estate agent. Your agent understands the home-buying process and can help you navigate it. He or she knows the market in your area, will make sure you have the information you need to make good decisions, and will protect your interests throughout the transaction. Also ask your prospective agents for their history in representing buyers. It's the List price - Close Price + Seller Subsidies. You may see a lot of agent activity in your prospect but without their history it's hard to monetize how they are representing their Clients' bottom-line.

0 Comments

Lately, with inventories of homes decreasing and demand for them increasing, you can bank on a bidding war for a home good condition or location. A Buyer who has come in second place multiple times is extremely motivated to just win a home. The Seller is very happy with a higher sales price. Here is how it might work. You may offer $500,000 to purchase a home with an escalation clause stating that you will outbid other offers by $5,000 up to a maximum $515,000. So if another buyer makes an offer of $505,000, your escalation clause kicks in and you now offer $510,000 for the home. If Buyer 3 offers $517,000, then according to your escalation clause you are out of the bidding, because the offers have gone over your $515,000 ceiling or cap. It is a good way for Buyers to be very competitive and not wildly over bid for a home. The dynamics of the process vary a great deal based on: How much experience both Real Estate Agents have

The one thing that affects both the Buyer and Seller is the Appraisal. The Appraisal and Financing Addendum is a part of most Northern Virginia Contracts. It is the great equalizer and independent of Buyer/Seller because the Appraisal is ordered by the Mortgage Adjuster to ensure they are not financing an over-valued property. If your winning escalation price for the home was $510.000 and the home appraised at $500,000 or $520,000. The Buyer may elect not to proceed with the Sale either because they can’t come up with the additional monies need to get to $520,000 (cash plus original loan) or because of a low appraisal and the Seller is not willing to negotiate the sale price down to the new appraised value. Usually this negotiation takes place and saves the day.

Into Solar? Your Social Media Friends Will Soon Know

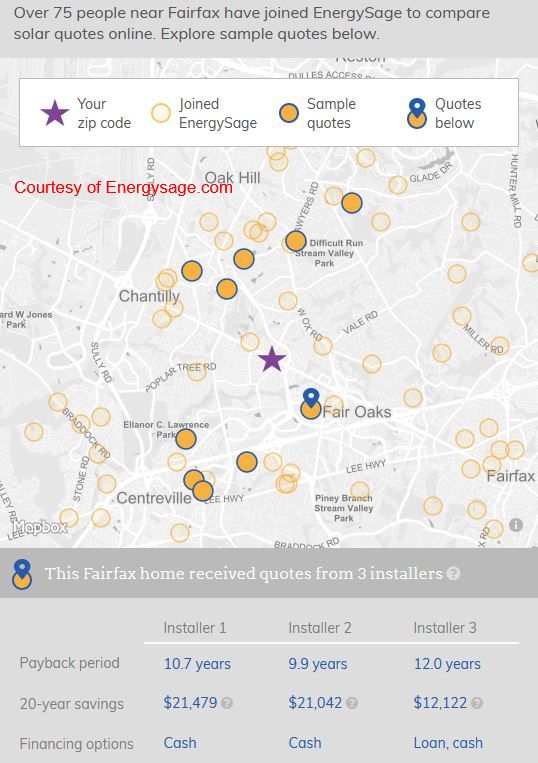

If you’re planning to install solar panels on your roof, your friends will soon know, thanks to Google’s “Project Sunroof.” As Google explains, Project Sunroof is a free online solar calculator that helps you map the potential savings from converting your roof to solar. Its objective: to map earth’s solar potential “one roof at a time.” Panels that absorb the sun’s energy and convert it to heat or electricity are covering rooftops around the globe, encouraged by any number of factors including financial (solar energy can be a cost-effective way to generate electricity) and now peer pressure. The newest addition to Project Sunroof shows a red dot on homes that appear to have solar panels. According to Robinson Meyer in a recent CityLab post, it “will now not only inform users how much sun hits their roof, or how much solar panels would save them per month, but also which of their neighbors have taken the plunge first.” Why is that important? Writes Meyer, “One of the best predictors of whether people install solar panels on their house isn’t their age, their race, their level of income, or their political affiliation … It’s whether their neighbors did it first.” According to The Department of Energy there is only 2 years left to receive a 30% Tax rebate on solar installation cost. The rebate are slated to end in 2022. The average return on investment varies from size of job and location in the USA but the country average of 7.5 years. Google is hoping take-up numbers will be driven by the desire to be the first in one’s social media network to hop on the new bandwagon. That could swell as more “influencers” opt to participate and bring their followers along. So check out Project Sunroof, install, and just wait for the online accolades. |

Moving to Northern Virginia

Dennis Bell and a lot of folks who have helped thousands to relocate. Archives

October 2018

Categories |

RSS Feed

RSS Feed